Changes in the semiconductor industry: how patent strategies need to adapt

Introduction

Nobody can deny that the semiconductor industry is going through something of a renaissance period. Semiconductors are firmly in the public eye thanks mainly to the ongoing chip shortages which have disrupted everything from car production to smart phone deliveries. On top of this, the industry’s reliance on East Asia, especially Taiwan, has led to US and European governments to make unprecedented state interventions, offering over $100bn to semiconductor companies to invest in production facilities in the US[1] and Europe[2].

IP has always played a central role in the semiconductor sector, with different types of companies requiring different Intellectual Property (IP) strategies. The sector includes three primary categories of companies, which are: a) the Integrated Device Manufacturers (IDMs), such as Intel and Samsung, who design and make their own chips; b) the fabless design companies, like Nvidia and Qualcomm, who design their own chips, and outsource manufacture to the foundries; and c) the pure-play foundries, like Taiwan Semiconductor Manufacturing Company (TSMC), who make chips for other companies. While IP is important for all of these types of companies, the licensing of IP is central to fabless design companies’ business models.

IP owned and asserted by these companies is referred to as the primary market. These companies sometimes sell IP to Non-Practising Entities (NPEs), who then try to monetise it through licensing and assertion. There is an evolving secondary market for semiconductor patents, with a number of NPEs snapping up ex-semiconductor company portfolios. For example, Daedalus Prime acquired a portfolio of Intel patents, and has begun asserting against various semiconductor companies[3]. We have also seen the foundries do battle, with TSMC and GlobalFoundries filing suits against each other[4]. As the foundry marketplace hots up in the US and Europe, will we see more disputes arise?

Changes are also afoot in the enforcement space, with Europe about to introduce a new patent court. The Unified Patent Court (UPC) is intended to improve access to patent litigation, by reducing the costs and the timescales of patent litigation in Europe. The arrival of this new forum is predicted to result in more patent litigation in Europe.

How do patent strategies need to change?

The changes outlined above present threats and opportunities for the semiconductor sector. How can semiconductor companies protect their market position, and what role will patents and trade secrets play? Here we outline three key areas that we believe semiconductor companies should be looking at in the coming months.

Increased importance of European and US patents

In Europe semiconductor companies often only seek protection in Germany, typically directly with the German patent office. This is because little semiconductor manufacturing occurs in Europe. Absent a competitive marketplace, there is little value in obtaining broad and expensive coverage. Even European semiconductor companies file relatively few applications outside of Germany. The chart below shows a breakdown of patent filings in H01L (the International Patent Classification (IPC) for semiconductors) in Europe[5].

![]()

The emphasis on securing patent protection in Europe is likely to see the greatest shift in global IP strategies. The EU CHIPS Act[6] promises investment in both design capability and manufacturing capacity. We are already seeing European semiconductor companies make big investments, with STMicroelectronics announcing plans for a new integrated silicon carbide (SiC) substrate manufacturing facility in Italy to meet increasing demand from automotive and industrial customers[7].

It will be important for semiconductor companies to keep a close eye on the market, to understand which companies are making investments, and where. As the STMicroelectronics announcement demonstrates, patent protection in countries other than Germany will likely take on increased importance. The multi-jurisdictional nature of Europe means that coverage in a greater number of countries is likely to be required, depending on the location of new research and manufacturing facilities. Furthermore, the arrival of the UPC and the associated Unitary Patent (UP) will require companies to think about whether national protection or Unitary Patent protection is best for their strategy.

The EU CHIPS Act also proposes collaborative research initiatives, which include provisions for the licensing of jointly developed IP. This is likely to increase the number of cross-licences being agreed, which in turn is likely to place a greater emphasis on the Unitary Patent. A single patent that covers multiple EU countries will have a higher value in licence negotiations than, for example, a national German patent.

US patents have always played a key part in the IP strategy of semiconductor companies. We expect to see less of a change here. However, the shift in foundry capacity to the US will require companies to pay greater attention to their US coverage as the importance of good quality, litigation-ready patents increases. We are likely to see an increased use of continuation applications to ensure products are well protected, as well as an increase in Inter Parties Reviews (IPRs) at the US PTO.

Greater focus on manufacturing technologies

Historically the foundries made product in Taiwan, and the design houses designed product in the US and Europe. The manufacturing processes used in Asian were generally kept as trade secrets, and the companies selling the products protected their products. Over time, the lines between foundries and semiconductor design houses have become blurred. Companies like Intel and Samsung are offering “pure-play” fabrication to third parties, thereby putting them into direct competition with the likes of GlobalFoundries and TSMC.

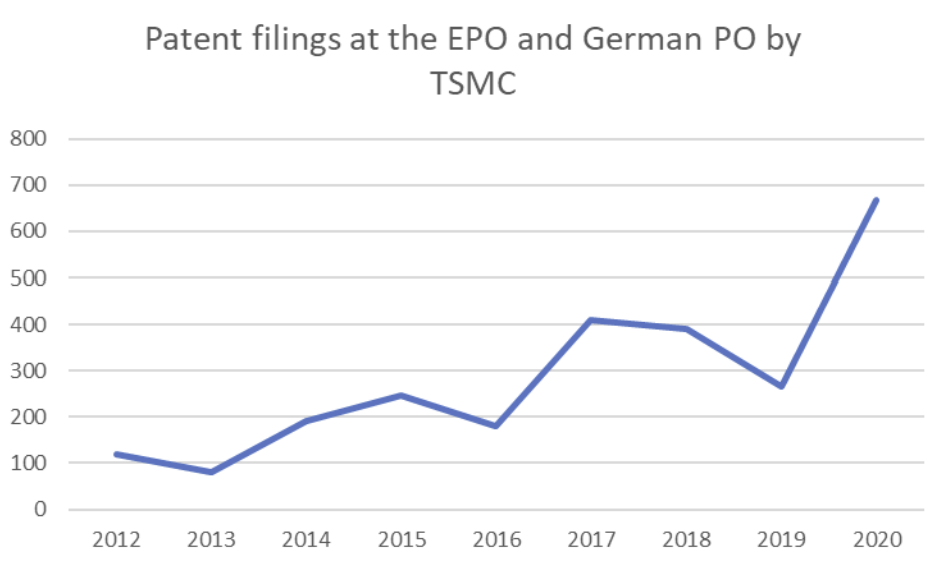

A real risk for the Integrated Device Manufacturers (IDMs) is a surge in patenting activity from the pure-play foundries, in particular on the device side. In fact, we have already seen an increase in patent filings from TSMC in Europe, as can been seen in the chart below.

The IDMs will need to carefully consider their approach to protecting manufacturing processes. Techniques that at one time would have been better off as trade secrets, may need to be patented to provide the IDMs with some defence against the pure-play foundries. The ability to detect process techniques in the end-product will still be relevant here, but we expect that the dial will shift further towards patents, and away from trade secrets.

The production of semiconductor devices also involves highly specialised machines which require a huge amount of capital expenditure (capex). Historically, the machines involved in semiconductor fabrication were designed by key US and European players such as Applied Materials and ASML. These machines were primarily sold to fabrication facilities in Taiwan and other East Asian countries. Given the limited number of machines sold, the capex involved and the significant barriers to entry, patent protection was regarded as less important. As with process patents, we expect to see an increase in patent flings towards the manufacturing machines themselves.

Generating value by protecting customers

Legacy patent strategies for most semiconductor companies would involve patenting innovation low down in the stack. An invention relating to the operation of a transistor would result in a patent for that improved transistor. This is valuable and provides protection for the company’s core innovations.

Such a low-level component may be well suited to a particular application, and even in a particular industry. For example, a transistor improvement may have particular use in a power regulation circuit which in turn may be well suited to an automotive application. Implementation of that circuit may involve challenges which result in patentable inventions.

Legacy patent strategies may have regarded this sort of application-level innovation as being the remit of the semiconductor companies’ customers. However, increasingly semiconductor companies are working in collaboration with their customers to provide products which solve industry-specific problems. As such, it is often the semiconductor engineers who are developing the solutions to those problems.

As an example, Texas Instruments (TI) recently obtained a patent directed to an automotive display validation technique (US patent number 11284062 B2[8]). The product sold by TI is most likely the system-on-a-chip (SoC) referred to in the patent, however TI has elected to seek protection for the application of their product in the automotive sector.

Companies should consider the value of industry-specific application-level solutions. Resulting patents may provide significant value and help protect customers. Application-level patents may simultaneously allow semiconductor companies to offer their customers protection from their competitors and leverage greater revenues from their collaboration efforts.

Collaboration between semiconductor companies to their customers is likely to result in more cross-industry litigation. And, just as we are seeing in the telecoms sector, it is likely that automotive companies will find themselves in disputes with semiconductor companies, or NPEs holding semiconductor patents. With an increased likelihood of being sued by companies from different sectors, the importance of having a defensive portfolio which goes beyond a company’s core IP will take on greater importance.

Conclusions

The semiconductor sector is going through some big changes. How semiconductor companies react to protect their market position will undoubtedly have an impact on their long-term futures. Intellectual property strategy will remain important, and we believe that now is the time for companies to put in place plans to deal with these issues. Careful consideration should be given to process technologies that might once have remained as trade secrets. Semiconductor companies should also be thinking about their customers and look for opportunities to increase value by patenting further up the stack to obtain industry-specific applications of their technology.

[1]CHIPS for America Act & FABS Act - Semiconductor Industry Association (semiconductors.org)

[2]European Chips Act | European Commission (europa.eu)

[3]Samsung, TSMC, Qualcomm hit with new offensive by NPE wielding Intel patents - IAM (iam-media.com)

[5]Patents filed in Europe in the last 10 years by the major European semiconductor companies.

[6]https://ec.europa.eu/info/strategy/priorities-2019-2024/europe-fit-digital-age/european-chips-act_en

[7] https://www.reuters.com/technology/stmicroelectronics-wins-european-commission-backing-italy-plant-2022-10-05/

[8] https://patentcenter.uspto.gov/applications/16017324